ONE NATION ONE TAX IS IMPLEMENTED IN INDIA (GOOD & SERVICE TAX)

People will never forget the date of July 1st in the history as the two major countries Saudi Arabia and India implemented a huge tax, Saudi implemented a Family Tax on expatriates and India implemented a GST (Goods & Service Tax) as One Nation One Tax.

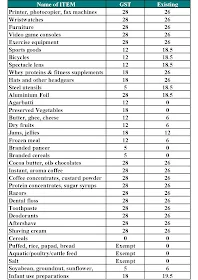

Indian government categorized 1211 items in various tax slabs from 0% to 28% of tax on both companies and individuals. We brought here those list for you.

- One of the good thing India was done is 0% tax or No Tax on few items like Jute, Meat, Fish, Chicken, Eggs, Milk, Butter Milk, Curd, Natural Honey, Fresh Fruits, Vegetablse, Flour, Bread, Salt, Bindi, Besan, Prasad, Bones, Sindoor, Stamps, Papers, Books, Bangles, Handlooms, etc,.

- The below picture will explain you more about the existing tax and the new GST (Goods & Service Tax) for various kinds of items.